Free Framework

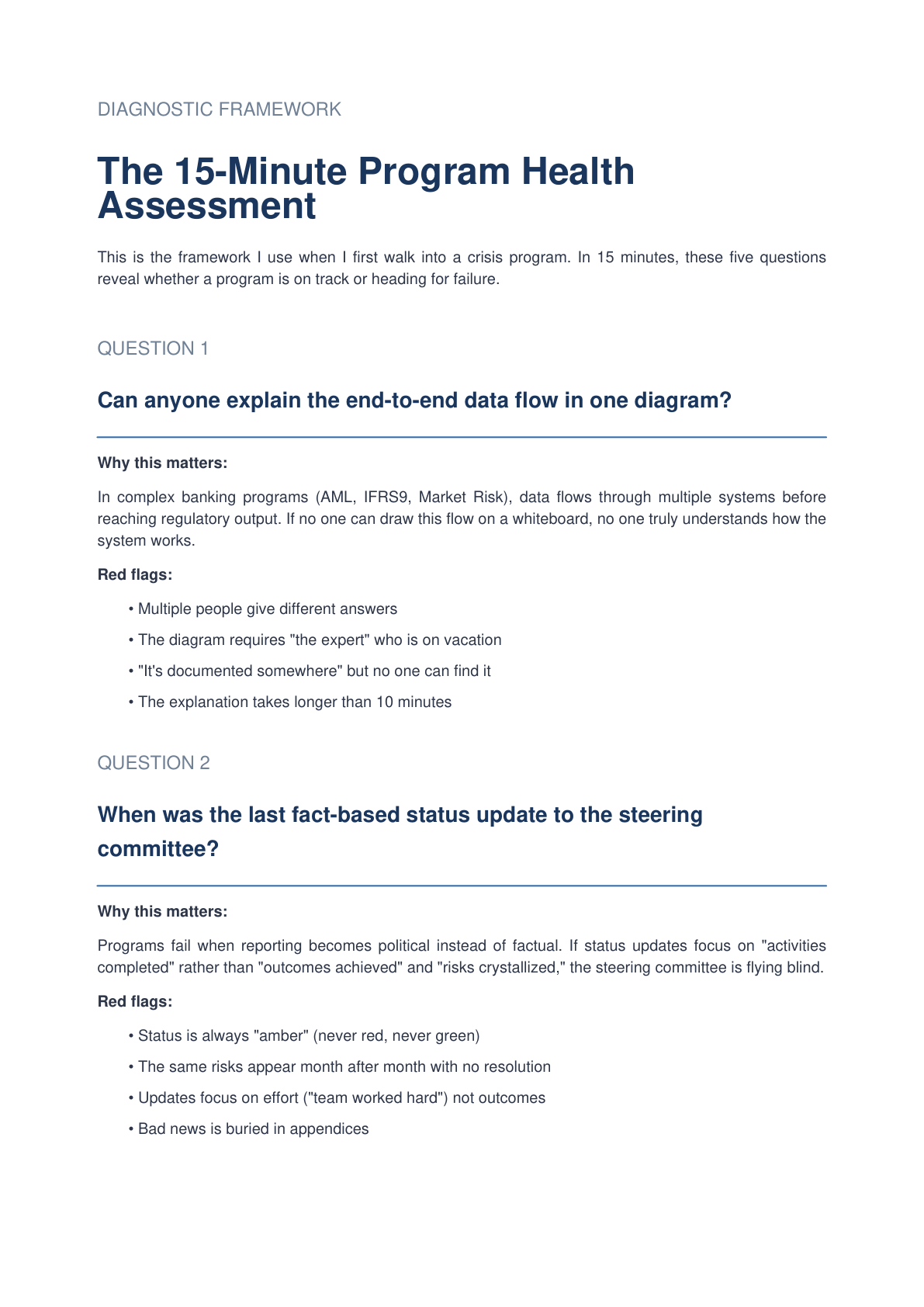

The 15-Minute Program Health Assessment

This is the framework I use when I first walk into a crisis program. Five questions that reveal whether a program is on track or heading for failure.

- Can anyone explain the end-to-end data flow?

- When was the last fact-based status update?

- If the regulator asked a hard question, who would answer?

- What's the biggest unresolved conflict between teams?

- What happens if we do nothing for 30 days?